Fidelity® Study: More Than Three-Quarters of Caregivers Report Financial, Social, Mental or Professional Setbacks

- Caregivers for Children Report Providing an Average of 61 Hours of Care a Week, Caregivers for Adults 28 Hours a Week; Six-in-Ten Overwhelmed by Financial Stress

- 64% of Caregivers Did Not Look Into Asking Employer Whether Special Benefits or Flexible Options Were Available

- Planning Can Make a Big Difference: Fidelity Has Resources, Introduces Free Calculator to Help Estimate Cost of Caregiving

BOSTON–(BUSINESS WIRE)–Caregiving may be one of the greatest acts of selflessness, but it also has a profound impact on one’s financial goals, social life, mental health and career, according to the Fidelity Investments®American Caregivers study. And while more than three-quarters (77%) of respondents say the choice to provide care was something they wanted to do regardless of the challenges, the pandemic has amplified their stress, with more than half of current caregivers saying their hours devoted to care have increased.

With the U.S. moving out of what appears to be the worst of the pandemic, now may be the ideal time for a reset, especially if caregivers ask for help, both at home and at work, and mindfully build a roadmap for success. The study, which examines the emotional and financial costs of caregiving, finds that more than half of respondents (59%) say from the start, the decision to become a caregiver was a mostly emotional rather than a practical decision, with 83% feeling they had no other choice but to assume the responsibilities. Of concern, 79% also say the decision set them back on a variety of fronts, including financial goals, social life, mental health and their career.

“Unless you’re in the thick of providing care, you may not realize the impact the experience can have,” said Stacey Watson, senior vice president of Life Event Planning at Fidelity Investments. “When a member of the family takes on caregiving responsibilities, others may not realize the true toll it takes. Awareness and communication are critical elements to a successful support system that benefits both the cared-for and the caregiver.”

The Impact of Caregiving on Careers

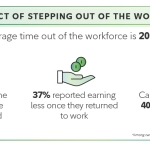

By far, the impact to one’s career can be one of the most difficult issues caregivers grapple with during the experience. On average, caregivers for children reported providing 61 hours of care per week; caregivers for adults, 28 hours per week. These obligations clearly make continuing employment responsibilities difficult, and according to the survey findings, more than one-quarter of caregivers for adults (28%) left a job, took a leave of absence, or shifted to part-time work in order to provide care. However, even for those adult caregivers who took short-term leave or didn’t leave at all, one-fifth (20%) say they’ve turned down or elected to not pursue opportunities at work because it would have interfered with their caregiving responsibilities.

For those whose circumstances compelled them to step away, the decision brought with it a host of financial challenges. The decision to leave the workforce also brings with it other “hidden” costs, including the adverse impact it may have on potential raises and promotions, contributions and potential growth of retirement savings, additional employer contributions to any retirement and/or health savings accounts (HSAs), health care coverage, and Social Security credits. According to the study findings, just one third (32%) took the time to calculate at least one of these costs, and very few calculated all. Perhaps as a result, 62% indicate they sometimes felt overwhelmed by the financial stress.

One practical solution to improve this situation is to actively seek out help from one’s employer, which may include asking about greater flexibility as well as financial and emotional support benefits. Depending upon your role, you may have more flexibility than you think. And yet, 64% of working caregivers said they did not look into asking their employer whether special benefits or flexible options were available. For the roughly one-third that did ask, most discovered their employer was willing to work to accommodate their needs.

As an example, this past year, Fidelity Investments evolved its own employee benefit support to respond to unexpected life events of associates and their families. This included access to expert care coordinators, including locating, interviewing, background checking and securing care and educational resources such as caretakers or tutors, as well as childcare cost assistance to help navigate the uncertainty. During this time, Fidelity also extended its caregiving benefit to help employees care for kids with behavioral and developmental disabilities and improved emotional well-being support with access to health professionals to assist with stress and anxiety.

To Lessen the Stress, Build a Roadmap for Success

One powerful, transformative step that often is overlooked: putting a solid plan in place to outline caregiving responsibilities. Only 15% of respondents say they actually put a roadmap together, while about three quarters of those who didn’t wish they had, feeling it would have reduced their stress levels. The data demonstrates that at every stage of the caregiving process—from deciding how to provide care, to the point at which caregiving is no longer being provided—those with a plan found the experience far less mentally stressful and can help with the unexpected.

People who put together a roadmap appear to have gotten more out of the experience, too. Putting a plan together doesn’t have to be too time consuming, either, as there are number of online resources available designed to help. The time spent appears well worth it. For those who identified and used other resources to develop and put a plan into place, an overwhelming 92% said using such a resource made caregiving significantly less stressful.

Take It from Other Caregivers: Don’t Be Afraid to Seek Out Assistance

When it comes to offering advice to people contemplating taking on caregiving duties, experienced caregivers agree that whenever possible, make planning for care a family affair, and don’t be afraid to ask for help.

“Caregiving can be a tremendously rewarding experience, but to lessen the emotional burden, having a good support system in place is essential.” said Watson. “Although selflessness comes with the territory, the problem with neglecting one’s own needs can be disastrous, creating a sense of helplessness and burnout. That’s why it’s important to take time to plan for as many contingencies as you possibly can—and don’t be afraid to ask for help when you need it.”

Finally, make sure to fully understand the financial impact of taking on caregiving responsibilities. Fewer than one in five caregivers took the time to estimate the full impact of lost wages, savings and social security benefits. To help make crunching the numbers easier, Fidelity recently introduced a calculator designed to gauge the cost of leaving the workforce and the negative impact on one’s earning potential.

Fidelity Offers Guidance, Resources on How to Make the Caregiving Process Less Stressful

For those looking for help at any point in the caregiving process, Fidelity has resources, tools and the guidance to help sort through things where and when you need it – whether it’s a roadmap from end-to-end, the ability to dive into a topic to get trusted insights and actionable next steps, or a chance to look ahead and learn what to expect. This includes:

- Fidelity’s Life Events offering, an online experience designed to help people move forward and plan for, anticipate and react to major moments in their lives—where and when they need it. As part of this, Life Events offers a wealth of material around caregiving planning. When it comes to caring for aging loved ones, fidelity.com/caregiving can help people understand the emotional, logistical and financial consequences of taking on care for a loved one. This includes a section devoted to conducting Constructive Family Conversations and Aging Well, a planning, conversation and resource guide to help families build a comprehensive plan.

- Educational Fidelity Viewpoints® articles, including “How to take care of aging parents and yourself,” and “The hidden costs of caregiving,” and “How do you care for others in stressful times?”

- Fidelity’s Women Talk Money discussion series provides an interactive forum sharing education and suggested next steps to help address today’s most pressing financial topics. As upwards of 75% of all caregivers are female and may spend as much as 50% more time providing care than males1, planning for and balancing caregiving responsibilities is one of many topics this monthly series has tackled. Register here to tune in live or on-demand.

- In-person guidance appointments at Fidelity’s more than 200 nationwide investor centers or by calling 800-FIDELITY.

About the Fidelity Investments 2021 American Caregivers Study

This study presents findings from a nationwide survey of 1,008 U.S. adults ages 18+ who are current or past (within last five years) caregivers to children or adults. This survey was fielded in April 2021 by Versta Research, an independent research firm not affiliated with Fidelity Investments. Caregivers to adults provided at least five hours of care per week. Caregivers to children must have left the workforce to do so or reduced to part time hours. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. For a detailed look at the Fidelity Investments’® American Caregivers Study, go here.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $10.7 trillion, including discretionary assets of $4.0 trillion as of April 30, 2021, we focus on meeting the unique needs of a diverse set of customers: helping more than 35 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 wealth management firms and institutions with investment and technology solutions to drive growth. Privately held for 75 years, Fidelity employs more than 47,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 0211

981719.1.0

© 2021 FMR LLC. All rights reserved.

___________________________________________

1 SOURCE: Institute on Aging (2016)

Contacts

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Ted Mitchell

401-292-3084

ted.mitchell@fmr.com

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom