Pandemic Put Lenders to “Digital Test,” J.D. Power Finds

American Express and Discover Rank Highest in a Tie in Personal Loan Satisfaction

TROY, Mich.–(BUSINESS WIRE)–According to the J.D. Power 2021 U.S. Consumer Lending Satisfaction Study,SM released today, the consumer lending space was severely disrupted during the COVID-19 pandemic as a combination of stimulus funding, record high mortgage refinance volume and a tenuous economy crimped the consumer loan market.

“The consumer lending landscape shifted dramatically over the past year and consumers need to understand that this shift will be permanent,” said Jim Houston, managing director of consumer lending and automotive finance intelligence at J.D. Power. “To attract and retain customers, personal lenders need to deliver easy-to-use technology and adapt communication channels to market demands.”

Following are key findings of the 2021 study:

- Customer satisfaction was flat for the Personal Loan industry: FinTech lenders see their overall satisfaction scores decline 5 points (on a 1,000-point scale) this year, due to slower application approval times and tighter credit criteria. By contrast, traditional bank and credit card-branded lenders see overall customer satisfaction scores rise 4 points this year.

- Trust in lending partners is up year over year: While the pandemic forced lenders to change how they do business overall industry trust improves. Traditional lenders significantly outperformed FinTechs in putting the customer first; providing guidance; is aligned with my social views; provides honest communication; treats people fairly; and provides more reliable technology.

- Easy-to-use websites and mobile apps gain even more importance: Lenders were forced to rely on digital means during the pandemic, especially traditional lenders. FinTech customers were more likely to use their personal computer to engage, while traditional lenders relied on mobile applications. No matter how they were accessed, secure and easy to use sites were high on consumer wants, as they continue to compare site use against all of their other web interactions.

Study Ranking

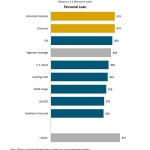

American Express (874) and Discover (874) rank highest in a tie among personal loan lenders in overall customer satisfaction. Citi (864) ranks third.

The J.D. Power U.S. Consumer Lending Satisfaction Study measures overall customer satisfaction based on performance in three factors: offerings and terms; loan management; and application and approval. The study is based on responses from 2,467 personal loan customers and was fielded in December-February 2021. The study also includes Home Equity Line of Credit (HELOC) customers, but this segment was not award-eligible in the 2021 study due to a lack of lenders with sufficient sample size.

For more information about the J.D. Power U.S. Consumer Lending Satisfaction Study, visit https://www.jdpower.com/business/financial-services/us-consumer-lending-satisfaction-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021054.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world’s leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com