CMS Releases Its 2022 Interim Report, Achieves Sustained Growth with Its Platform Strategy

SHENZHEN, CHINA, Aug 26, 2022 – (ACN Newswire) – China Medical System Holdings Limited (“CMS”, 867.HK) released its 2022 interim report on August 22. In the first half of 2022, CMS delivered an outstanding interim results — it achieved stable performance growth in several business segments, and solid progress in clinical development and registration of innovative products in China, and launched Southeast Asia business to empower its long-term development.

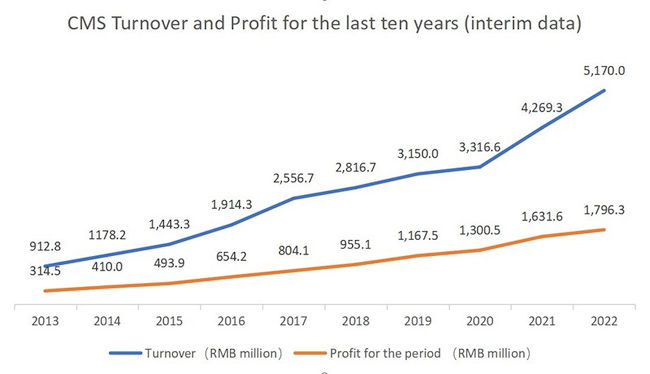

According to CMS’ 2022 interim report, the turnover was RMB4,447.8 million (H1 2021: RMB3,843.0 million), representing an increase of 15.7% over the same period last year; in the case that all medicines were directly sold by the Group, the turnover would increase by 21.1% to RMB5,170.0 million (H1 2021: RMB4,269.3 million). Profit for the period was RMB1,796.3 million (H1 2021: RMB1,631.6 million), representing an increase of 10.1% over the same period last year. CMS’s turnover and profit for the previous ten interim periods have maintained a sound growth momentum with both CAGR exceeding 20%.

Rooted deeply in pharmaceutical industry, the Group has developed a product portfolio covering cardio-cerebrovascular, gastroenterology, central nervous system, dermatology medical aesthetics, ophthalmology, pediatrics and other specialty therapeutic fields. With leading drugs commercialization capability in China, CMS achieved excellent financial performance and initiated its unique “collaborative R&D and investment” innovative R&D strategy. The year of 2022 marks the 30th anniversary of CMS’s establishment. As a mature pharma, CMS has maintained steady growth momentum, and has continuously expanded its business boundary with platform strategy. The 2022 interim report shows the future growth potential of CMS.

Commercialization platform: enabling steady growth of “Cardio-cerebrovascular and Gastroenterology” business and rapid development of emerging business, “ophthalmology” and “dermatology and medical aesthetic”.

The commercialization capability is the core competitive advantage of CMS and the cornerstone of its continuous growth. The Group’s marketed product lines, including cardio-cerebrovascular, gastroenterology, ophthalmology, dermatology and medical aesthetic line, all achieved steady growth in the first half of 2022. Among which, cardio-cerebrovascular and gastroenterology lines, CMS’s traditional business, increased by 26.0% and 17.4% respectively year-on-year. The core products have maintained strong growth momentum after being commercialized for years, and several products have ranked first among peers, which is rare and it highlights the value of CMS’s commercialization platform.

As the core emerging strategy of CMS in recent years, the “ophthalmology” and “dermatology and medical aesthetic” businesses, with product matrix being expanded while business system getting shaped, have both achieved steady growth by leveraging the Group’s commercialization capability.

In particular, CMS has been engaged in the ophthalmology field for many years. Both its core product Augentropfen Stulln Mono Eye drops and innovative pipeline Cyclosporine Eye Drops 0.09% have attracted considerable attention. In July 2022, the Group acquired the global assets related to VEGF/ANG2 tetravalent bispecific antibody from Wuhan YZY Biopharma Co., Ltd, which further enriched its innovative pipeline in the ocular fundus diseases treatment field; In August, the Group entered into an agreement with EYE TECH CARE (“ETC”), a medical company of France, for the EyeOP1 ultrasound glaucoma treatment device and made an equity investment to acquire approximately 33.4% equity interest in ETC. CMS’s ophthalmology product matrix has expanded from prescription medicine to devices and consumables through this collaboration, while CMS’s academic platform and channel resources accumulated over years in the ophthalmology field will provide a solid foundation for the rapid development of new products. Based on this, CMS has built a clearer development path for its ophthalmology business that featured with high-growth potentiality.

For the dermatology and medical aesthetics business, since the Group promoted its independent operation in 2021, the Group has acquired several medical aesthetics specialty companies and multiple marketed products with professional brands in the field, which have accelerated its development in the dermatology prescription and medical aesthetic fields. The focused ultrasound technology R&D platform of CMS, is developing three major series of products, including FUBA Focused Ultrasound Fat Reduction Device Series, LITU Focused Ultrasound Skin Treatment Series, and MEBA Ultrasonic Transdermal Delivery Series, to further expand its energy-based medical aesthetic devices product portfolio. In August 2022, CMS acquired 60% equity interest in Heling Medical, and entered into an exclusive license agreement for three dermatology-grade skincare products. Heling will act as the Group’s R&D platform for dermatology-grade skincare products and accelerate the category expansion and product iteration for CMS. With the operation system of “CMS Aesthetics” getting shaped and the continuous acquisition of new products, CMS is steadily moving forward with its professional operation, compliance management and resource advantages in this rapidly developing and gradually regulated medical aesthetic market.

Innovation platform: “collaborative R&D and investment” strategy broadened its innovation development potential

With commercialization capability being its foundation of innovative R&D, CMS has developed its innovative strategy — “collaborative R&D and investment” that could best leverage its strengths and capabilities. Capitalizing on its strong commercialization gene, extensive academic resources, as well as deep market understanding, CMS is able to identify unmet clinical needs with a sharp business insight, and locate differentiated innovative products with both social and economic value through precise product evaluation.

Nowadays, relying on its increasingly matured innovative R&D team and project management system, while constantly acquiring mature innovative products, CMS also collaborated with biotech companies with innovative technology platforms, to jointly develop innovative products, which could make the most of respective strengths and improve the R&D efficiency by shortening the R&D cycle and reducing expenses. Meanwhile, with its improving scientific mindset and R&D capabilities, the Group actively participated in the target selection and development path planning of innovative products, to conduct customized development of innovative products. Through multi-dimensional collaborative development models, CMS has formed an “innovative product incubation platform” empowering the development of innovative clinical practice in the world.

At present, CMS has acquired nearly 30 innovative products, mainly first-or best-in-class products, among which 9 products have been approved for marketing in the U.S./Europe. During the Reporting Period, 3 products of CMS were under NDA review in China, 1 product was approved for marketing in Hong Kong of China, 1 product’s NDA was granted the priority review designation by the CDE, and 3 products’ China bridging trials were progressing steadily after the completion of first subject dosing. CMS’s innovation development is expected to enter a maturing phase and delivering harvest.

Relying on its innovation transformation platform, CMS is capable to manage the R&D processes and rapidly promote the clinical trial progress. The Group has submitted NDA of several innovative products, including Tildrakizumab Solution for Injection and Methotrexate pre-filled injection in China, which only took 1-2 years since acquisition. In July 2022, CMS has overcome challenges under pandemic prevention and control, and took only 6 months (including the Chinese Spring Festival) to complete the enrollment of all 1,800 subjects in China bridging trial of Methylthioninium Chloride Enteric-coated Sustained-release Tablets. It took only 2.5 months (including the Spring Festival) to complete the enrollment of all 220 subjects in the China bridging trial of Tildrakizumab previously.

With its platform getting increasingly matured, CMS is expected to benefit from the multiplier effect the platform provides and enhance its future scalability.

Southeast Asia Platform: A one-stop operating platform empowers global pharmaceutical companies to enter Southeast Asia market

CMS 2022 interim report indicated it has achieved impressive progresses in the Southeast Asia market.

With the rapid development of China bio-pharmaceutical industry, increased industrial scale and enhanced drugs quality and scientific research level, Chinese pharmaceutical companies have gained stronger competitiveness in the global market, which has presented a critical opportunity for Chinese pharmaceutical companies to develop overseas market. Compared to the United States, Europe, and Japan market with mature pharmaceutical system, Southeast Asia and other emerging markets have greater unmet pharmaceutical demands and provide more opportunities. Pharmaceutical industry trends in the past two years indicates that the Southeast Asia market has drawn great attention and the connection between China innovative drug industry and Southeast Asia market has been getting stronger. At this point, CMS stands out with comprehensive Southeast Asia business development strategy.

Given the information in its 2022 interim report, CMS Southeast Asia business has achieved preliminary results. It has set up an independent operating entity with clear organizational structure, and has built a core team for its business in Southeast Asia, CMS aimed to form a platform covers innovative R&D, production and sales, helping Biotech and pharmaceutical companies in Europe, America, Japan, and China to rapidly enter the Southeast Asia market and achieve mutual beneficial cooperation and strategic complementarity.

In terms of products, CMS newly acquired the innovative EyeOP1 Glaucoma Treatment Device in August 2022, which has been approved for marketing in Southeast Asia. At the same time, CMS’s Southeast Asia business entity has obtained exclusive rights for several insulin products in 11 countries in Southeast Asia, which is an initiative for insulin products of mainland China to enter the Southeast Asia market. As a rigid demand for diabetes, this product series has the advantages of excellent quality and affordable price. In Southeast Asia market, the major insulin products are European and American imported products with high price and the penetration of insulin products is significantly insufficient, which indicates a huge market potential.

The platform in Southeast Asia market is bound to become an important engine driving CMS’s future development.

Conclusion

Platform building requires a solid foundation, but the potential of the platform is unlimited. As a “Platform Company”, CMS will leverage its accumulated advantages to continuously optimize it platform, thus laying a solid foundation for its high growth and business sustainability.

As of now, CMS ‘s PE-TTM is trading only 7.2 times, and its TTM dividend yield reaches 5.5%. Given its growth potential, steady operation, organized development strategy, combined with the strong resilience of the pharmaceutical and medical aesthetic industries, CMS can achieve ” Davis Double Strike ” is worth looking forward to.

Media Contact

Media Team, CMS

Email: ir@cms.net.cn

Website: http://www.cms.net.cn/

Source: China Medical System Holdings Ltd.

Copyright 2022 ACN Newswire. All rights reserved. www.acnnewswire.com