WhiteWater Midstream and MPLX LP Announce Substantial Completion of Agua Blanca Pipeline System Expansion

AUSTIN, Texas–(BUSINESS WIRE)–WhiteWater Midstream (WWM) and MPLX LP (NYSE: MPLX) today announced the substantial completion of a 1.8 billion cubic-feet-per-day (Bcf/d) expansion of their joint venture Agua Blanca pipeline system. Testing and commissioning of the expansion will begin this month, and the system is anticipated to be brought into full service in early 2021.

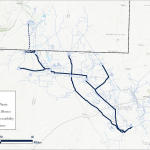

The Agua Blanca system is connected to almost 20 gas processing sites in the Delaware Basin and is currently transporting gas produced in Culberson, Loving, Reeves, Pecos, Winkler and Ward counties in Texas, and Eddy and Lea counties in New Mexico, to the Waha Hub. The Agua Blanca expansion includes a 42-inch diameter trunk line that more than doubles system capacity to over 3 Bcf/d while providing significant incremental takeaway capacity for plants servicing Texas and New Mexico gas producers.

“We are excited to bring this expansion into service ahead of schedule while continuing to provide reliable and transparent transportation services to producers and processors in Texas and New Mexico,” said WhiteWater Chief Executive Officer Christer Rundlof. “WWM remains committed to developing premier Permian basin residue assets as markets normalize and growth resumes.”

WhiteWater Midstream’s investment in the Agua Blanca joint venture is led by First Infrastructure Capital. Inquiries regarding the Agua Blanca Expansion should be directed to ab@wwm-llc.com.

About WhiteWater Midstream

WhiteWater Midstream is a management owned, Austin based midstream company. WhiteWater Midstream is partnered with multiple private equity funds including but not limited to Ridgemont Equity Partners, Denham Capital Management, First Infrastructure Capital and the Ontario Power Generation Inc. Pension Plan. Since inception, WhiteWater has reached final investment decision on ~$3 billion in greenfield development projects. For more information about WhiteWater Midstream, visit www.whitewatermidstream.com.

About MPLX LP

MPLX is a diversified, large-cap master limited partnership that owns and operates midstream energy infrastructure and logistics assets and provides fuels distribution services. MPLX’s assets include a network of crude oil and refined product pipelines; an inland marine business; light-product terminals; storage caverns; refinery tanks, docks, loading racks, and associated piping; and crude and light-product marine terminals. The company also owns crude oil and natural gas gathering systems and pipelines as well as natural gas and NGL processing and fractionation facilities in key U.S. supply basins. More information is available at www.MPLX.com

About First Infrastructure Capital

First Infrastructure Capital Advisors, LLC is a Houston-based investment firm specializing in greenfield projects and companies operating in the midstream, downstream, electric power, telecommunications, and renewable energy industries. First Infrastructure Capital Advisors, LLC is an SEC-registered investment adviser, which manages funds affiliated with First Infrastructure Capital, L.P. For more information about First Infrastructure Capital, visit www.firstinfracap.com.

This press release contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements relate to, among other things, statements with respect to forecasts regarding capacity, rates, incremental investment, market conditions and timing for becoming operational for the opportunities discussed above. You can identify forward-looking statements by words such as “anticipate,” “design,” “estimate,” “expect,” “forecast,” “plan,” “project,” “potential,” “target,” “could,” “may,” “should,” “would,” “will” or other similar expressions that convey the uncertainty of future events or outcomes. Such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the control of the companies and are difficult to predict. Factors that could impact the opportunities described above are set forth under the heading “Risk Factors” in MPLX’s Annual Report on Form 10-K for the year ended Dec. 31, 2019, and Quarterly Reports on Form 10-Q, filed with the Securities and Exchange Commission (SEC). In addition, the forward-looking statements included herein could be affected by general domestic and international economic and political conditions. Unpredictable or unknown factors not discussed here or in MPLX’s Forms 10-K and 10-Q could also have material adverse effects on forward-looking statements. Copies of MPLX’s Forms 10-K and 10-Q are available on the SEC’s website, MPLX’s website at http://ir.mplx.com or by contacting MPLX’s Investor Relations office.

Contacts

Investor Relations Contacts:

WhiteWater Midstream

Bryan Willoughby

Director, Business Development

(512) 953-2100

www.whitewatermidstream.com

MPLX

Kristina Kazarian

Vice President, Investor Relations

(419) 421-2071