Sumsub Launches A Seamless KYB solution That Makes Business Verification 24x Faster

As global demand for legal entity checks increases, Sumsub is here to help companies verify their business clients, stay compliant and avoid huge fines.

London, March 16, 2022 — Anti-fraud and verification platform, Sumsub, is launching a KYB solution for fast and effective verification of companies.

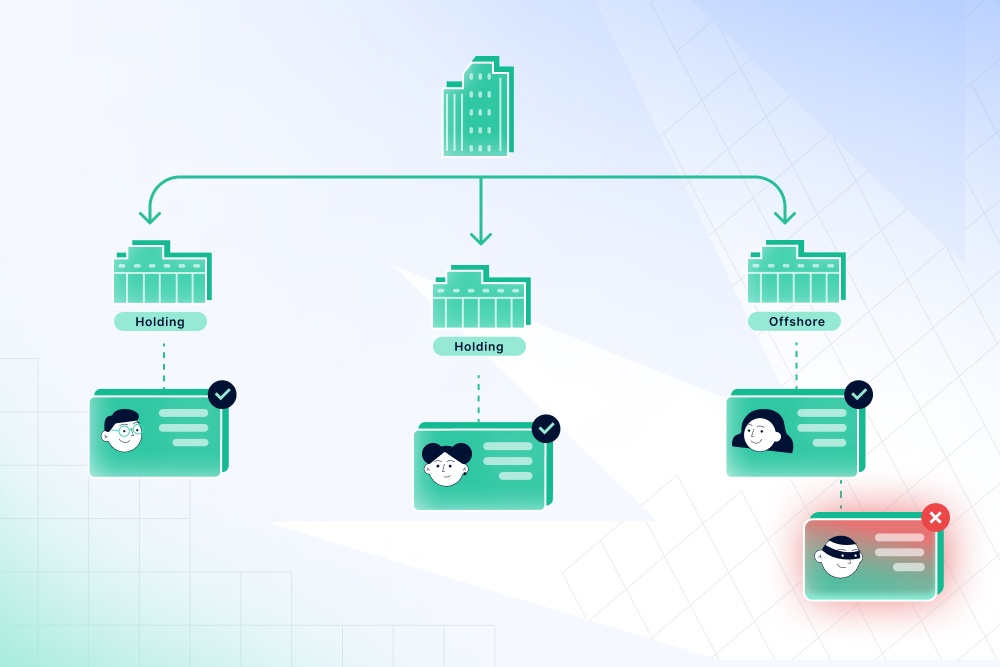

Know-your-business (KYB) verification is performed by companies who want to make sure that the businesses they work with are legit and trustworthy. Generally, the KYB procedure consists of checking company documents in global and local registries, verifying the identities of beneficiaries, and performing special anti-money laundering (AML) checks.

KYB checks are increasingly recommended for institutions in the financial industry. This includes those dealing in mobile payments, online banking, crypto marketplaces and crypto services.

On the regulatory front, KYB is now woven into the guidelines of multiple regulators including the European Banking Authority (EBA) and FATF. This means that certain companies can now face penalties if they fail to perform KYB checks.

“Just recently we witnessed several high-profile incidents that revealed fundamental inadequacies in the procedures of onboarding of legal entities. This problem affected even the giants, such as Credit Suisse. Indeed, the vast majority of obliged entities already use modern technologies and solutions when they onboard individuals; this is the new normal. But when it comes to KYB we still see manual work and mistakes that are absolutely normal for and inherent to the human factor. Some of these mistakes may be innocent but others may open the door to huge money laundering schemes and ruin reputations of transnational financial businesses and even countries.

Some time ago our existing clients identified this risk as a problem and asked us whether we could extend our current ecosystem to include automated onboarding of legal entities as well. And we did it. Now we see that the demand for KYB is growing day after day; international policymakers like EBA are mentioning KYB among the recommended innovative technologies. We are welcoming the global demand to make legal entity checks a really meaningful part of due diligence procedures.” — says Tony Petrov, Sumsub’s Chief Legal Officer.

Most companies do not have enough resources or expertise to handle KYB checks, as they often lack access to consolidated public resources of company information (global and local registries, watchlists, etc). Therefore, KYB processes are usually outsourced to compliance officers who perform them manually—a process that may take up to three working days (or 72 hours per company) to complete due to the difficulty of collecting all of the required info and documentation. Ultimately, these long wait times turn clients towards competitors.

Sumsub offers a full-cycle KYB solution designed to help companies verify their business counterparties faster and more effectively. The solution consolidates automated KYB checks, beneficiary KYC checks and manual review by certified KYB/AML experts.

Sumsub’s autoKYB check takes only 3 minutes to perform, and full-cycle KYB verification can be performed in as little as 3 hours–which is up to 24 times faster than manual KYB verification. Sumsub has access to data on more than 200 000 000 companies and beneficiaries from registries across 220 countries and territories.

Unlike other digital verification providers, Sumsub offers a customisable widget (WebSDK) for collecting applicant information that can be embedded to a company’s website to reflect corporate identity or branding requirements. This also means that the verification flow—uploading docs, filling questionnaires, collecting beneficiary information—can be adapted according to specific demands or regulations. Sumsub’s KYB check is also convenient for businesses undergoing the check—as all necessary documents can be uploaded by a single company representative.

In addition, Sumsub’s KYB solution lets customers continuously monitor the status of companies and their beneficiaries in real-time. All of this data is stored and managed in one place, and full reports are prepared for companies to show to regulators.

All in all, Sumsub can be your single contractor for KYB verification. Companies who delegate all their KYB-related procedures to Sumsub are able to reduce operational costs, overall verification time, and increase applicant conversion worldwide.

About Sumsub

Sumsub is an international tech company that helps businesses onboard online clients and comply with AML/KYC regulations with AI-driven identity verification tools. It was founded by three brothers—Andrew, Jacob, and Peter Sever—and uses forensic anti-fraud software to make identity verification fast, secure, and transparent for clients.

Sumsub’s business model is based on adjusting verification & identification services to global compliance requirements. Thanks to a strong in-house legal team, Sumsub has grown into a leader within this sector, helping businesses comply with regulations in more than 220 countries. The company’s methodology follows FATF recommendations—the international standard for AML/CTF rules.

Sumsub offers an all-in-one, customizable solution that verifies users no matter their language or location—helping businesses scale to international markets faster and adhere to global compliance requirements more efficiently. The platform is easily adjustable and offers a wide range of solutions, from fully-automated identity verification to agent-assisted verification.

Sumsub takes a risk-based approach and follows both global and local regulatory norms (FATF, FINMA, FCA, CySEC, MAS). All data is kept on Amazon GDPR-compliant servers, which are located in the EU. Overall responsibility for all data lies with the DPO (Data Protection Officer).