Home Insurance Customer Service and Reputation—Not Price—Drive Lifetime Customer Value, J.D. Power Finds

COUNTRY Financial Ranks Highest in Homeowners Insurance; Lemonade Ranks Highest in Renters Insurance

TROY, Mich.–(BUSINESS WIRE)–The median age of first-time home buyers has increased to 33 years, the oldest age on record since the National Association of Realtors began tracking this data in 1981. What’s that mean for home insurers? The battle to drive lifetime value in home insurance customer relationships now hinges on the ability to capture new customers as early as possible by converting renter insureds to homeowner insureds. According to the J.D. Power 2020 U.S. Home Insurance Study,SM released today, the key to building that long-term relationship with homeowners has less to do with low price and more to do with great service and reputation.

“Homeowners insurance customers are the single-most-valuable group of personal lines customers for P&C insurers,” said Robert M. Lajdziak, senior consultant of insurance intelligence at J.D. Power. “They have a significantly higher bundling rate, 38% higher product penetration beyond home and auto, and their tenure is twice the length of a monoline auto customer. The potential ‘lifetime customer value’ of homeowners makes meeting their needs and motivations to renew a critical task for the industry. This dynamic will be important to watch as insurtech start-ups—which have recently gained traction in the renters insurance marketplace by offering low prices—gear up with unique value propositions that will challenge traditional insurers that are more focused on building relationships and delivering strong customer service.”

Following are some key findings of the 2020 study:

- Customer experience is key to lifetime value: Good customer service is the single factor driving the highest level of intent to renew with an existing carrier. Two-thirds (67%) of homeowners insurance customers who’ve selected a brand based on good service experience say they “definitely will” renew with that insurer. Reputation (64%) and convenience (64%) follow as top drivers of intent to renew. Price as a reason for initial insurer selection is one of the lowest-ranked motivators driving homeowners customer retention.

- Renters more focused on price: In the renters insurance marketplace, price is a bigger motivator. The primary reason for selecting a renters insurance provider is price, according to 52% of renters insurance customers. Price is an even greater driver of provider selection among Lemonade customers, with 71% of this insurtech’s customers indicating that price influenced their carrier selection.

- Millennials heavily influenced by good service: Millennial1 customers are significantly more likely to select their homeowners insurer due to good service experience than are Boomers. Overall, 38% of Millennials say they selected their homeowners insurance carrier based on good service experience, compared with 34% among Boomers.

- Smart home technologies create opportunity: Nearly two-thirds (63%) of Millennial homeowners have smart home products, and this age group is more than twice as likely as Boomers to use insurer-provided tools to inventory their possessions. Customers who use these tools say they have a significantly higher level of engagement with their insurer, thereby creating additional opportunities to add value through good customer service.

Study Rankings

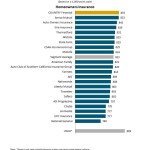

COUNTRY Financial ranks highest in the homeowners insurance segment, with a score of 855 (on a 1,000-point scale), performing particularly well in customer relationship-related factors. Amica Mutual (853) ranks second and Auto-Owners Insurance (843) ranks third.

Lemonade ranks highest in the renters insurance segment with a score of 866, marking the first time an insurtech brand ranks highest in a J.D. Power insurance study. Erie Insurance (865) ranks second and Allstate (841) ranks third.

The U.S. Home Insurance Study examines overall customer satisfaction with two distinct personal insurance product lines: homeowners and renters. Satisfaction in the homeowners and renters insurance segments is measured by examining five factors: interaction; policy offerings; price; billing process and policy information; and claims. The study is based on responses from 11,942 homeowners and renters via online interviews conducted in June-July 2020.

For more information about the 2020 U.S. Home Insurance Study, visit https://www.jdpower.com/business/resource/jd-power-us-household-insurance-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2020113.

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world’s leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power is headquartered in Troy, Mich., and has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JD.Power.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com