Strategy Analytics: Samsung Wins Almost Half of the Smartphone Memory Market in Q1 2021

High-Capacity Multi Chip Package Memory Drive Shipments

BOSTON–(BUSINESS WIRE)–According to the latest research from Strategy Analytics, the global smartphone memory market clocked a total revenue of $11.4 billion in Q1 2021.

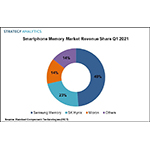

The research states that Samsung Memory led the smartphone memory market with 49 percent (DRAM & NAND) followed by SK Hynix and Micron in Q1 2021 as per Strategy Analytics Handset Component Technologies research report, “Smartphone Memory Market Share Q1 2021: Samsung Memory Captures Top Spot.”

Samsung Memory, SK Hynix and Micron captured more than 80 percent revenue share in the global smartphone memory market in Q1 2021.

NAND Market

In Q1 2021, the smartphone NAND flash market witnessed 18 percent year-over-year growth in revenues driven by the adoption of UFS NAND flash chips, especially in mid and high-tier devices. Samsung Memory claimed the top spot with a revenue share of 42 percent followed by SK Hynix with 20 percent and Kioxia with 19 percent share in the smartphone NAND market in Q1 2021.

DRAM Market

The smartphone DRAM memory chip revenue observed an annual revenue growth of 21 percent in the quarter owing to the increase in new 5G device launches by smartphone customers. Samsung Memory led in terms of market share, capturing a revenue share of 54 percent followed by SK Hynix and Micron each having 25 percent and 20 percent respectively in the smartphone DRAM market in Q1 2021.

Jeffrey Mathews, Senior Analyst at Strategy Analytics said, “The recovery in the smartphone end-market resulted in early customer orders for memory vendors who shipped high-density memory chips to some of the key smartphone models. Samsung Memory, SK Hynix and Micron all gained share aided by the shipment of high capacity Multi Chip Package (MCP) based memory solutions. We note that UFS Multi Chip Package (uMCP) unit share reached nearly 30 percent driven by the shipment 128GB NAND and 6GB DRAM memory configurations in the quarter.”

According to Stephen Entwistle, Vice President of the Strategy Analytics Strategic Technologies Practice, “The strong demand for 5G smartphones creates a tailwind for the smartphone memory market growth. Memory vendors are expected to cater to the 5G demand with the introduction of high capacity UFS 3.1 and LPDDR5 Multi Chip Package memory solutions. However, the ongoing non-memory component shortages could dampen the memory market prospects.”

About Strategy Analytics

Strategy Analytics, Inc. is a global leader in supporting companies across their planning lifecycle through a range of customized market research solutions. Our multi-discipline capabilities include: industry research advisory services, customer insights, user experience design and innovation expertise, mobile consumer on-device tracking and business-to-business consulting competencies. With domain expertise in: smart devices, connected cars, intelligent home, service providers, IoT, strategic components and media, Strategy Analytics can develop a solution to meet your specific planning need. For more information, visit us at www.strategyanalytics.com.

Source: Strategy Analytics, Inc.

#SA_Components

For more information about Strategy Analytics

Service Name: Handset Component Technologies

Contacts

Report contacts:

Author: Jeffrey Mathews, +44 (0)1908 423 615, jmathews@strategyanalytics.com

European Contact: Stephen Entwistle, +44 (0)1908 423 636, sentwistle@strategyanalytics.com

US Contact: Christopher Taylor, +1 617 614 0706, ctaylor@strategyanalytics.com