Infinity Stone Options Zen-Whoberi Copper-Cobalt-Platinum-Palladium Project, Quebec

Vancouver, British Columbia–(Newsfile Corp. – May 30, 2022) – Infinity Stone Ventures Corp. (CSE: GEMS) (OTC Pink: TLOOF) (FSE: B2I0) (formerly Contakt World Technologies Corp.) (the “Company” or “Infinity Stone“) is pleased to announce that it has entered into a property option agreement (the “Option Agreement“) with 3EX Resource Corp. (“3EX“) respecting an option to acquire the 353.2-hectare Zen-Whoberi Copper-Cobalt-Platinum-Palladium Project (the “Project“), located 30 kilometres north of Mont Laurier, Quebec.

Project Highlights

- Historical results from 2006 and 2007 work programs by Quinto Resources Inc. (“Quinto“) with highlighted intervals including 0.57% Cu over 22.8 metres and 1.27% Cu over 3.8 metres from a single geophysical anomaly.

- Gold, platinum, and palladium encountered in historical drilling and trenching by Quinto, including 1.1g/t Au over 1.2 metres and 0.8 g/t Pt over 1.06 metres in hole CB-06-05, and several trench grab samples including T06-11 yielding 5.07% Cu, 0.59g/t Au, 3.9g/t Pt and 0.2g/t Pd.

- Numerous parallel geophysical anomalies, most of which remain untested.

- The Zen-Whoberi Project is located approximately 300km from Glencore Canada’s (“Glencore”) Horne Smelter, located in Rouyn-Noranda, QC, Canada’s only operating copper smelter, and approximately 270km from Glencore’s Canadian Copper Refinery (CCR) in Montreal, QC, Canada’s only operating copper refinery.

Historical Diamond Drilling

In 2006, Quinto completed a drilling program of six diamond drill holes, which encountered significant copper mineralization including 0.57% Cu over 22.8 metres and 1.27% Cu over 3.8 metres along a 200-metre strike length.

The six short drillholes encountered copper mineralization corresponding with a single, large geophysical anomaly over 450 metres in length and open in both directions. Five other parallel anomalies remain to be explored.

Anomalous grades in gold, platinum and palladium were noted in most of the 2006 drill holes, including 1.1g/t Au over 1.2 metres and 0.8 g/t Pt over 1.06 metres in hole CB-06-05.

In 2007, five additional diamond drill holes were completed. Four of these holes encountered significant mineralization, as detailed below in Table 1.

Table 1: 2006-2007 Diamond Drilling Summary

| Hole | Azimuth (º) | Dip (º) | From (m) | To (m) | Length (m) | Cu (%) |

| CB-06-01 | 348 | 60 | 3.2 | 9.3 | 6.1 | 0.59 |

| incl. | 4.5 | 8.2 | 3.7 | 0.92 | ||

| CB-06-02 | 162 | 60 | 2.4 | 7.9 | 5.5 | 0.68 |

| CB-06-03 | 0 | 90 | 15.9 | 25.5 | 9.6 | 0.56 |

| incl. | 15.9 | 21.3 | 5.4 | 0.84 | ||

| and | 28.5 | 37.3 | 8.8 | 0.27 | ||

| CB-06-04 | 0 | 80 | 1.1 | 9.3 | 8.2 | 0.21 |

| CB-06-05 | 0 | 80 | 12.9 | 35.7 | 22.8 | 0.57 |

| incl. | 29.6 | 34.7 | 5.1 | 1.08 | ||

| and | 37.3 | 44.4 | 7.1 | 0.7 | ||

| incl | 38.3 | 43.5 | 5.2 | 0.88 | ||

| CB-06-06 | 0 | 80 | 3.1 | 35.8 | 32.7 | 0.47 |

| incl. | 21.5 | 25 | 3.5 | 1.21 | ||

| incl. | 31 | 34.8 | 3.8 | 1.27 | ||

| F07-01 | 350 | 52 | 52.2 | 53.55 | 1.35 | 0.27 |

| and | 109.8 | 111.6 | 1.8 | 0.18 | ||

| F07-02 | 360 | 75 | 147.25 | 149.0 | 1.75 | 0.16 |

| F07-03 | 200 | 45 | 22.5 | 24.1 | 1.6 | 0.17 |

| and | 50.0 | 51.5 | 1.5 | 0.19 | ||

| F07-04 | 20 | 45 | 46.7 | 48.35 | 1.65 | 0.14 |

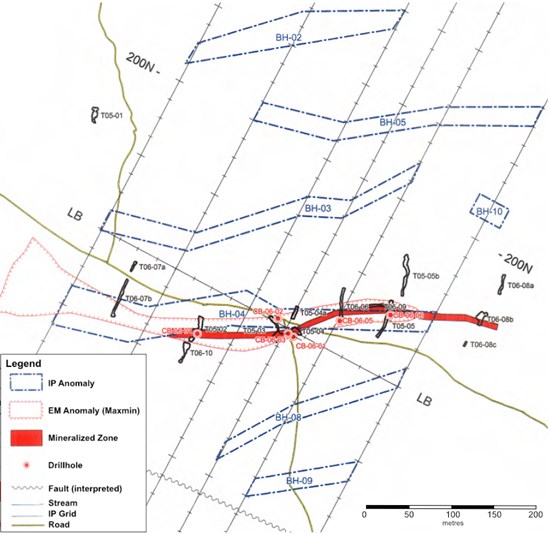

Figure 1: Composite Map

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/8151/125765_86c264c86491e87a_002full.jpg

Historical Trenches (2005 to 2007)

In 2005, Quinto completed a total of five trenches on the Property (T05-01 through T05-05), with four intersecting significant mineralization. Out of five trenches, four uncovered significant mineralization. These historical results are summarized in Table 2 below.

Table 2: 2005 Trenching Summary

| Trench | Highlight Interval (m) | Cu (%) |

| T05-01 | 0.58 | 0.33 |

| and | 0.8 | 0.32 |

| T05-02 | 3.7 | 0.38 |

| T05-03 | 6.45 | 2.22 |

| and | 5.3 | 2.57 |

| T05-04 | 8.4 | 0.78 |

| and | 5.3 | 1.03 |

All samples taken in the 2006 trenching program were grab samples. Trench T06-11 was targeted to expand the Bornite Hill showing. Out of nine grab samples, the best two results showed 5.07% Cu, 0.59g/t Au, 3.9g/t Pt and 0.2g/t Pd (Sample 190840) and 3.9% Cu (Sample 109842). Trench T06-12 was an expansion of T05-04, wherein the best of six total grab samples yielded 0.38% Cu in a quartz-feldspar-biotite gneiss. Seven grab samples were taken from T06-13 (expansion of T05-05) of which the best result was 0.2g/t Pd in a calc-silicate rock with disseminated sulphides (cpy-py-po). From six grab samples at T06-14, two diopsidite samples yielded 0.22 g/t Au and 0.27 g/t Pd (Sample 190960) and 0.57 g/t Pd (Sample 190958). Pt and Pd were only analyzed in trenches T06-13 and T06-14.

Trenching confirmed the presence of disseminated pyrrhotite, chalcopyrite, bornite and massive pyrite in diopside-rich calcosilicate rocks. This mineralization is also present as disseminated within quartz-feldspar-biotite gneisses, marbles and quartzites. The mineralization seems to be found mainly in the hinges of folds, but it is also found in veinlets in a network of sub-vertical fractures oriented E-NE.

About The Zen-Whoberi Project

The Zen-Whoberi property comprises six claims covering 353.2 hectares located north of Mont Laurier, Quebec. It is located in the central metasedimentary belt of the Grenville geological province. The copper mineralization occurs as a skarn in the form of disseminated sulphides (pyrrhotite, chalcopyrite and bornite) in calcosilicate rocks.

Deal Terms

Pursuant to the terms of the Option Agreement, the Company has been granted the right to acquire a 100% interest in and to the Property (the “Option“), which may be exercised as follows:

- the Company issuing an aggregate of 1,200,000 Class A Subordinate Voting Shares of the Company (“Shares“), with 600,000 Shares issuable within five (5) business days of the date of the Option Agreement, and 600,000 Shares issuable on or before the first anniversary of the Option Agreement;

- the Company incurring aggregate exploration expenditures on the Property of $300,000, with $100,000 on or before the first anniversary of the Option Agreement, and an additional $200,000 on or before the second anniversary of the Option Agreement; and

- the Company paying an aggregate of $15,000, which has previously been paid.

Upon the Company exercising the Option, the Company will grant to 3EX a net smelter returns royalty (the “NSR Royalty“) totaling 2% on commercial productions from the Property. The Company has the right to repurchase 100% of the NSR for $2,000,000.

References

- SIGEOM Report GM 61701 (2005)

- SIGEOM Report GM 63162 (2007)

Qualified Person

The technical information in this news release has been reviewed and approved by Rémi Charbonneau, P.Geo., a “Qualified Person” as defined under NI 43-101 Standards of Disclosure for Mineral Projects.

About Infinity Stone Ventures

Infinity Stone’s mission is to be a diversified, single source supplier for the critical energy metals being used in the clean energy revolution alongside its established SaaS solution portfolio. The Company’s primary business units include HealthCheck (Stratum Health Technologies LLC) and its energy metals portfolio. Infinity Stone is meeting the demand from battery and wind turbine manufacturers, and energy metals speculators by acquiring 100% interest in critical mineral deposits and occurrences in stable mining-friendly jurisdictions, close to final use destinations in North American manufacturing hubs.

To register for investor updates please visit https://infinitystone.ventures.

Infinity Stone Ventures Corp.

Zayn Kalyan

CEO and Director

zayn@altuscapital.ca

Direct: 778-938-3367

The Canadian Securities Exchange has not reviewed, approved or disapproved the content of this news release.

Forward-Looking Statements Disclaimer

This press release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “projects”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements, including statements respecting: future exploration at the Property, and the Company’s exercise of the Option. Although forward-looking statements contained in this press release are based upon what management of Company believes are reasonable assumptions, there can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements may also be affected by risks and uncertainties in the business of the Company, including those described in the Company’s public filings available on www.SEDAR.com. The Company undertakes no obligation to update forward-looking statements if circumstances or management’s estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/125765