Greenlight Adds Family Safety Capabilities to Help Parents Raise Financially-Smart, Independent Teens

Leading fintech becomes first to combine family finance and family safety with new Greenlight Infinity offering

ATLANTA–(BUSINESS WIRE)–Greenlight® Financial Technology, Inc. (“Greenlight”), the fintech company on a mission to empower parents to raise financially-smart, independent kids, today announced Greenlight Infinity, a first-of-its-kind subscription plan designed to help parents power their teens’ independence with personal finance and safety features for the whole family.

Greenlight’s award-winning debit card and banking app have helped more than 5 million parents and kids learn critical financial skills like how to earn, save, spend wisely and invest. With Greenlight Infinity, the company now brings parents everything they need to teach their kids to manage money, stay connected and get help in emergencies with the addition of new safety features that support teens’ journeys into adulthood.

Growing up means spending more time away from home and learning new life skills like how to manage money, drive a car or get a part-time job. These milestones help teens develop independence but also introduce new challenges for parents to ensure their teens’ safety. Half of parents (50%) ranked physical safety as one of their top three concerns for their children, alongside health (66%) and education (64%) in a Greenlight survey.*

“Millions of parents trust Greenlight to help them raise financially-smart kids,” said Tim Sheehan, co-founder and CEO of Greenlight. “Greenlight Infinity does even more to help parents by keeping their kids safe and connected with family as they grow into adulthood.”

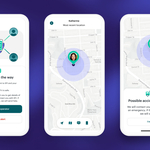

The Greenlight Infinity plan integrates family safety directly into the Greenlight app for both iOS and Android, alongside its core financial tools for earning, saving, spending wisely and investing. New features include:

- Location sharing: Family members can opt in to location sharing to stay connected. Once activated, both parents and teens can view locations of the entire family or by individual to easily check in with one another at any time.

- SOS alerts: In the event of an emergency, teens and parents can send an instant SOS alert to emergency contacts, 911 or both with one tap, so any family member can quickly call for help when they need it.

- Crash detection with automatic 911 dispatch: Family members can activate crash detection in the Greenlight app as a precaution while driving. If a crash is detected, a 911 dispatch team will be automatically notified and send help if needed.

- 5% on savings: Alongside new safety features, teens can earn a 5% Greenlight Savings Reward, more than 50 times the average savings account interest rate, to help build long-term wealth and reward smart money management.

“Teens today are always on the go from after-school activities to social plans to first jobs. Keeping kids safe while fostering responsibility and freedom can be a difficult balance,” said Cathy Pedrayes, family safety expert and author of “The Mom Friend Guide to Everyday Safety and Security.” “The new Greenlight Infinity plan offers a perfect solution with excellent personal finance and safety tools to help parents power their teens’ independence.”

Greenlight Infinity will be available at greenlight.com for $14.98 per month for the whole family. Other monthly Greenlight subscription plans start at $4.99 per month.

*Survey insights were collected by Greenlight through a survey fielded between August 18 – 24, 2021 among 1,500 parents in the U.S.

About Greenlight

Greenlight Financial Technology is the family fintech company on a mission to help parents raise financially-smart, independent kids. Its product, Greenlight, is an award-winning banking app, complete with a debit card for kids and teens and safety features for the whole family.

Parents can automate allowance, manage chores, set flexible spend controls and invest for their family’s future. Kids and teens learn to earn, save, spend wisely, give and invest with parental approval. Together, families can also stay safe and connected with location sharing, SOS alerts and crash detection with automatic 911 dispatch to get help if they need it.

The Greenlight Debit Card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by Mastercard International. Greenlight Investment Advisors, LLC, an SEC Registered Investment Advisor, provides investment advisory services to its clients. Investing involves risk and may include the loss of principal. Greenlight is a financial technology company, not a bank. The Greenlight app facilitates banking services through Community Federal Savings Bank, Member FDIC. For more information, please visit: greenlight.com.

Contacts

Jessica Tenny

Director of Communications

comms@greenlight.com