RETRANSMISSION: Kovo HealthTech Reports Q1 2022 Financial Results

+246% Year-over-Year Revenue Growth

+105% Year-over-Year Organic Growth

Vancouver, British Columbia–(Newsfile Corp. – May 17, 2022) – Kovo HealthTech Corporation (TSXV: KOVO) (the “Company” “Kovo”) — a leader in healthcare technology and Billing-as-a-Service — today reported its first quarter financial results for the period ending March 31, 2022.

+246% YOY Revenue Growth

Kovo posted 246% year-over-year (“YoY”) revenue growth during the quarter driven by a combination of organic growth of its core SaaS-style medical billing software and services business — and two strategic and accretive acquisitions the Company completed in 2021.

The record-setting quarter contributed to an Annualized Recurring Revenue (“ARR”) of approximately $12 million USD, which puts Kovo on-track to meet its previously disclosed 2022 initial guidance. EBITDA results for the quarter were neutral (0%) versus a loss of $176,000 (21%) in the same quarter last year, reflecting an improvement over the prior year.

+105% YOY Organic Growth

Excluding revenue growth attributed to its successful 2021 acquisitions, Kovo posted YOY organic growth of 105%. Organic growth for the quarter was driven primarily by two new client contracts signed in Q2 2021, confirms Kovo CEO Greg Noble, who anticipates one of those contracts will continue to benefit the Company’s cash flow throughout 2022.

Delivering Consistent Revenue Stability Over 13 Quarters

“At a time when the world economy is facing rising costs and uncertainty, Kovo continues to generate predictable and stable revenues,” explains Noble. “Q1 2022 marks our 13th quarter of delivering consistent, revenue stability and that is setting the Company up in a position of strength as we continue to explore future prospective 2022 acquisition targets,” he says.

Continued Focus on Strengthening Positive Monthly Cash Flow

“Kovo is consistently and reliably delivering positive cash flow from our RCM operations, and we continue to focus on improving our working capital month-over-month, while readying the Company for our next roll-up, accretive acquisition,” explains CFO Inder Saini, adding that the company is on-track to meet the 30% organic growth target (exclusive of acquisitions) outlined in its initial 2022 guidance released earlier this year.

Quarter Highlights:

Listed in thousands USD unless otherwise specified

- Revenue for the three months ended March 31, 2022 was $2,837, the largest in the Company’s history and 246% higher than revenues of $820 for the three months ended March 31, 2021.

- ARR as at March 31, 2022 was approximately $12,000, a 200% increase over March 2021. The first quarter of the year is historically a seasonal low for the business but the Company is still on track with its original guidance of $12,000 for the year.

- Kovo continues to consistently and reliably deliver positive cash flow from its RCM operations.

- Annual and quarterly revenue growth was generated by a combination of new sales and the acquisition of new clients via the M&A transactions.

- The Company completed its 13th consecutive quarter of positive Adjusted EBITDA reflecting the long-term operating discipline with the organization. Adjusted EBITDA was $46 for the three months ended March 31, 2022 relative to Adjusted EBITDA of $70 for the three months ended March 31, 2021. Adjusted EBITDA margin was 2% for the three months ended March 31, 2022 (three months ended March 31, 2021- 9%). The Company is focusing on investing its operations with continued investment in staffing and operations. These step costs are transitory and required to support future acquisitions which will provide greater economies of scale, and return EBITDA to historical percentages.

- On April 20, 2022 the Company received approval from the U.S. Small Business Administration (“SBA”) under the Economic Injury Disaster Loan (“EIDL”) program administered by the SBA, that their loan has been modified and the funded amount has increased from $150 to $2,000. This results in working capital shifting from negative $1,668 to positive $182. The loan continues to carry an interest rate of 3.75% per annum and is amortized over 30 years.

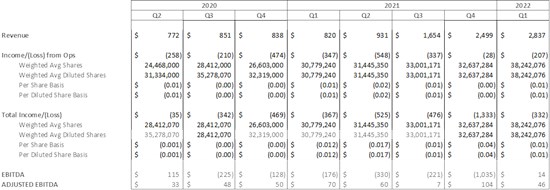

SELECTED QUARTERLY INFORMATION

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/8064/124361_a47548ef44c28ac4_001full.jpg

Detailed Quarterly Financial Statements, the Company’s MD&A and related documents can be accessed at www.sedar.com

**Subject to TSXV final approval.

About Kovo HealthTech Corporation

Kovo HealthTech Corporation is a growing healthcare technology company that specializes in Billing-as-a-Service offering SaaS-style recurring revenue contracts and software for more than 1700 US healthcare providers. Kovo helps healthcare providers digitally track and manage complex patient care registration, services, billing and payments in a seamless way, using its industry-leading OneRev technology platform. Currently, through its clients, Kovo processes over $250 million CAD ($200M USD) in annual billing transactions for more than 3.5 million patients. By offering effective billing practices and technology through long-term SaaS-style contracts, Kovo helps healthcare practitioners get paid so they can focus on offering quality care. To learn more about Kovo and to keep up-to-date on Kovo news, visit www.kovo.co

For more information:

Greg Noble, CEO

investors@kovo.co

1-866-558-6777

Manish Grigo

VP Corporate Development

manish@kovo.co

Forward-Looking Information and Statements

This press release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking information”) concerning the Company and its subsidiaries within the meaning of applicable securities laws. Forward-looking information may relate to the future financial outlook and anticipated events or results of the Company and may include information regarding the Company’s financial position, business strategy, growth strategies, acquisition prospects and plans, addressable markets, budgets, operations, financial results, taxes, dividend policy, plans and objectives. Particularly, information regarding the Company’s expectations of future results, performance, achievements, prospects or opportunities or the markets in which the Company operates is forward-looking information. In some cases, forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “targets”, “expects”, “budgets”, “scheduled”, “estimates”, “outlook”, “forecasts”, “projects”, “prospects”, “strategy”, “intends”, “anticipates”, “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might”, or “will” occur. In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Statements containing forward-looking information are not historical facts but instead represent management’s expectations, estimates and projections regarding future events or circumstances.

Many factors could cause the Company’s actual results, performance, or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking information, including, without limitation, those listed in the “Risk Factors” section of the final prospectus of the Company dated May 26, 2021. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results, performance, or achievements could vary materially from those expressed or implied by the forward-looking statements contained in this press release. Forward-looking information, by its nature, is based on the Company’s opinions, estimates and assumptions in light of management’s experience and perception of historical trends, current conditions and expected future developments, as well as other factors that the Company currently believes are appropriate and reasonable in the circumstances. Those factors should not be construed as exhaustive. Despite a careful process to prepare and review forward-looking information, there can be no assurance that the underlying opinions, estimates and assumptions will prove to be correct. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking information. Although the Company bases its forward-looking information on assumptions that it believes were reasonable when made, which include, but are not limited to, assumptions with respect to the Company’s future growth potential, results of operations, future prospects and opportunities, execution of the Company’s business strategy, there being no material variations in the current tax and regulatory environments, future levels of indebtedness and current economic conditions remaining unchanged, the Company cautions readers that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which the Company operates may differ materially from the forward-looking statements contained in this press release. In addition, even if the Company’s results of operations, financial condition and liquidity, and the development of the industry in which it operates are consistent with the forward-looking information contained in this press release, those results or developments may not be indicative of results or developments in subsequent periods. This press release makes reference to certain non-IFRS measures. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of the Company’s results of operations from management’s perspective. The Company’s definitions of non-IFRS measures used in this release may not be the same as the definitions for such measures used by other companies in their reporting. Non-IFRS measures have limitations as analytical tools and should not be considered in isolation nor as a substitute for analysis of the Company’s financial information reported under IFRS. The Company uses non-IFRS financial measures, including “ARR”, “EBITDA”, “Adjusted EBITDA*” and “Adjusted EBITDA Margin” to provide investors with supplemental measures of its operating performance and to eliminate items that have less bearing on operating performance or operating conditions and thus highlight trends in its core business that may not otherwise be apparent when relying solely on IFRS financial measures. “EBITDA” means net income (loss) before amortization and depreciation expenses, finance and interest costs, and provision for income taxes. *”Adjusted EBITDA” adjusts EBITDA for stock-based compensation expense, transactional gains or losses on assets, asset impairment charges, interest income, net foreign exchange gains or losses, income tax expense or recovery, forgivable one-time government financial payments related to the COVID-19 pandemic (“PPP Loans”), and any transactional expenses. Specifically, the Company believes that Adjusted EBITDA, when viewed with the Company’s results under IFRS and the accompanying reconciliations, provides useful information about the Company’s business without regard to potential distortions. By eliminating potential differences in results of operations between periods caused by factors such as depreciation and amortization methods and restructuring, impairment and other charges, the Company believes that Adjusted EBITDA can provide a useful additional basis for comparing the current performance of the underlying operations being evaluated. The Company believes that securities analysts, investors and other interested parties frequently use non-IFRS financial measures in the evaluation of issuers. The Company’s management also uses non-IFRS financial measures in order to facilitate operating performance comparisons from period to period.

Although the Company has attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to the Company or that the Company presently believes are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information, which speaks only as of the date made (or as of the date they are otherwise stated to be made). Any forward-looking statement that is made in this press release speaks only as of the date of such statement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/124361